The department gives a 10% tax credit boost to domestic “energy communities”.

The Department of the Treasury released its final guidance for clean energy project tax credits solidifying how clean energy companies can receive tax credits for investing in historic energy towns. The United States has small towns everywhere dedicated to the extraction and distribution of coal, oil, and fossil fuels. To help America have a smoother transition to clean energy power sources, the Treasury is extending a 30% tax credit for wind and solar projects and adding an extra 10% to projects investing in these “energy communities.”

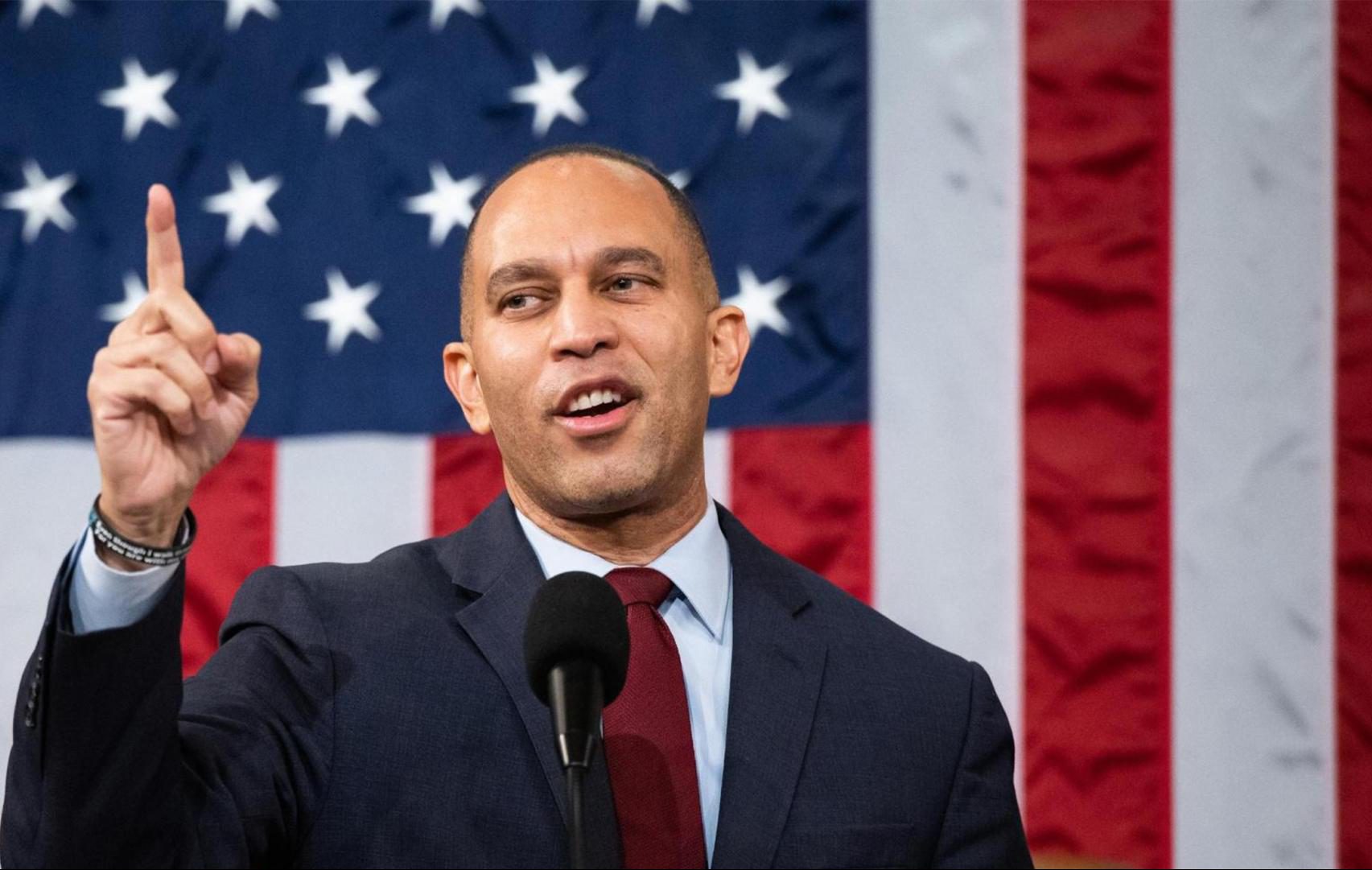

“Communities like coal communities have the knowledge, infrastructure, resources and know-how to play a leading role in the move to a clean energy economy,” U.S. Deputy Treasury Secretary Wally Adeyemo said. For projects to qualify for this extra tax credit, they must be installed in or near a statistical area that has rising unemployment and has recently had 25% of its local tax revenues related to the energy industry.

As the Lord Leads, Pray with Us…

- That these tax credits lead to greater investments into America’s many energy towns.

- For the Department of the Treasury as they organize the filings required to uphold these tax credits.

- That administration officials would follow the Lord’s guidance in every action they take.

Sources: Treasury Department, Reuters